About SMEF

Are you a financier interested in furthering the growth and development of small and medium-sized enterprises (SMEs) all over the world? Export Portal has an exciting new opportunity for you: SME Finance (SMEF).

Join SMEFWhat is SMEF?

SMEF is where Export Portal connects third-party trade financing providers (SMEF Partner) with our SME importers and exporters in our ecosystem for the best-possible lending options. SMEF is designed to bridge global SME trade finance gap of 1.4 trillion US dollars (WTO) with very high loan rejection rate at 50%+ (IFC). Every effort to boost 25% growth in trade financing would stimulate the growth of 19% in investment, 20% in job creation, and 30% in production for global economy.

SMEF partners will be incentivized to have access to the rich pool of qualified trade leads and choose to finance transactions with our verified and certified borrowers at lower credit risk and greater profit scale. As a result, SMEF partners will gain more competitive advantages and stronger market positions. SMEF will play an important role in the mission and benefit from our growing network of thousands and potentially millions of international businesses in our strategic markets and industries.

How does it work?

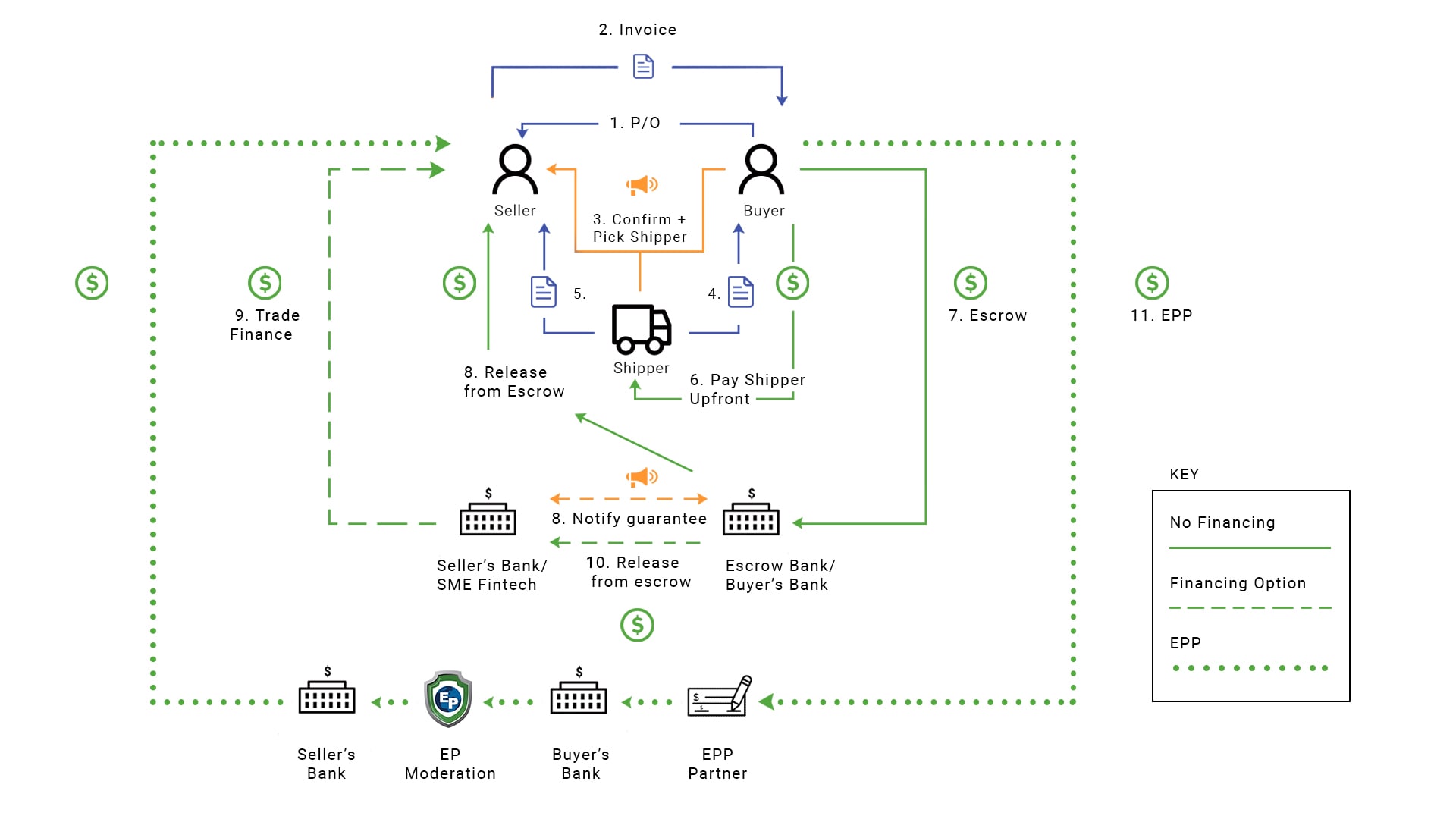

Export Portal Trade Transaction

SMEF provides new opportunities for SMEs to start fulfilling their potential on Export Portal. In the trade transaction, members will have the opportunity to seek financier support through SMEF directly on the platform. Here's how that works:

EXPORTER FINANCING

Sellers and manufacturers will be offered diverse financing options by Export Portal's financier partners (SMEF partners) who are SME-focused financial institutions, banks, and fintech companies. Once a trade order is paid through escrow by buyer and confirmed by EP administrator, the seller can leverage their beneficiary status of the escrow as a collateral to seek for export financing. Through our API, SMEF partners will be notified the financing order placed by the seller in relation to the confirmed transaction and the seller's information for credit review and bidding. Once bidding requirements (e.g. the principal amount, LTV, interest rate, loan term and other provisions) are matched, the seller will accept the loan for preparing the products. After the delivery is complete that triggers the release of Escrow account, the funds will be directly transferred to the respective SMEF partner for loan repayment, and the balance will be paid to seller.

IMPORTER FINANCING

Our Importer financing options are currently being developed and will be announced once they are available. If you have any questions about our process, please contact us.

WHO CAN JOIN SMEF?

Any financial institutions (Banks, Fintechs, Private Equity Firms, etc.) that recognize the significant SME trade financing opportunity and currently find effective ways monetize it.