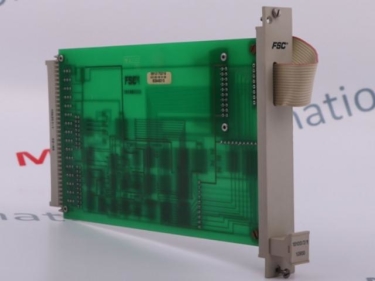

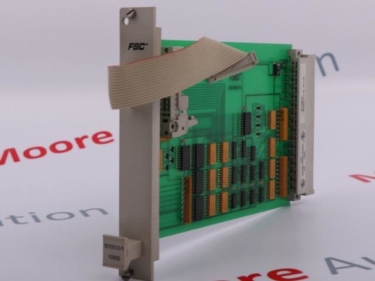

HONEYWELL FC-TSAI-1620M

HONEYWELL FC-TSAI-1620M

- 1

- 2

Couldn't find the product you want?

Fill out this form to request the product.

Exports

By producing things and selling them to different countries around the world, China has transformed the world economy with it. For instance, in 1900 the country produced only 3 percent of global manufacturing output. Today, China's share is nearly a quarter. It manufactures 80 percent of world's air conditioners, 70 percent of mobile phones and 60 percent of its shoes. China also exports large amounts of machines, furniture, clothing, medical equipment, vehicles, gems, iron products and more. So if you are looking for trusted portal to sell and export any product directly from China and shipping it to your home country, Export Portal can help you.

Export Portal's mission is to build a trusted trade bridge between global buyers and Chinese exporters, Chinese manufacturers, Chinese suppliers, Chinese sellers, etc., by creating new business opportunities for direct sourcing of quality products. Just browse for keywords that match the products you are interested in and find what you want quickly and easily. The export/import portal comprises a huge number of Chinese company profiles and Chinese product catalogs in over 1000 categories and subcategories.

Chinese shopping online is becoming more and more popular. Export Portal is one stop destination for Chinese sellers and buyers across the globe to interact and conduct international business smoothly and effectively.

Customs requirements of China

China Customs Contacts

Website: http://english.customs.gov.cn/

Email: customsinfo@hgtj.cn

Address: No.6. Jianguomennei Avenue, Dongcheng District, Beijing, China

Tel: +86 10-65195884

China is the world's 2nd largest state in terms of area and the world's 2nd largest economy. It is situated in Asia and it is bordered by 16 countries: North Korea, Russia, Mongolia, Kazakhstan, Kyrgyzstan, Tajikistan, Afghanistan, Pakistan, India, Nepal, Bhutan, Myanmar, Laos, Vietnam, Hong Kong, Macau. China is a member of the United Nations, World Trade Organization, World Bank, International Monetary Fund and the Association of Southeast Asian Nations (ASEAN).

Tariffs

Importers and exporters dealing with China have to pay 3 types of taxes: value-added tax, consumption tax and customs duties.

The imported products are subject to a general VAT tax of 17 %, and 13% for some products.

A consumption tax is applied to luxury products, non-renewable energy products and passenger cars. The consumption tax is based on the ad valorem or quantity value and there is no stable tariff.

Customs duties comprise import and export duties, calculated on the ad valorem or quantity value of goods.

Products licenses, labelling and packaging

Most products imported to China do not need an import licence if they are registered with China's Ministry of Commerce. An import license is needed for goods such as meat, dairy, fish and other seafood. Other products requiring a permit are: all the restricted goods (chemicals, drugs, ozone depleting substances), goods which are licensed automatically but are still monitored (poultry, tobacco, vegetable oils, copper, coal, aluminium, natural and synthetic rubber, pesticide and chemical fertilisers, asbestos, crude and processed oil, mechanic and electrical products).

Labelling

The label must contain the following information:

- name and trademark of the product

- ingredients

- net weight and solid content

- name, address and telephone number of the manufacturer

- production date (y /m / d) and storage instructions

- packer / distributor (name and address)

- batch number

- country of origin

- quality guarantee and/or storage period (y / m / d)

- usage instructions

Packs must be safe and easily degradable and recyclable. The wood packages should contain an IPPC (International Plant Protection Convention) stamp.

Documents for import/export

The main documents required when trading with China are the following:

- commercial invoice

- bill of Lading

- air waybill

- packing list

- pro forma invoice

- certificate of Origin

- CITES permit (a document certifying that the imported products follow the international wildlife protection regulations; it is necessary for goods such as exotic leather goods, wooden musical instruments, timber, medicines etc.)

Sources:

http://www.china-briefing.com/news/2013/03/11/import-export-taxes-and-duties-in-china.html

http://www.cnbuyers.net/article-547-china-import-export-taxes.html

http://www.chinaimportexport.org/china-import-and-export-documents-forms-and-samples-complete-list/